News

Forests & Finance assesses the finance received by over 300 companies directly involved in the beef, soy, palm oil, pulp and paper, rubber and timber supply chains, whose operations may impact natural tropical forests and the communities that rely on them in Southeast Asia, Central and West Africa, and parts of South America. A beta dataset also assesses the finance received by 22 mining companies operating in the same regions.

Start Exploring Now

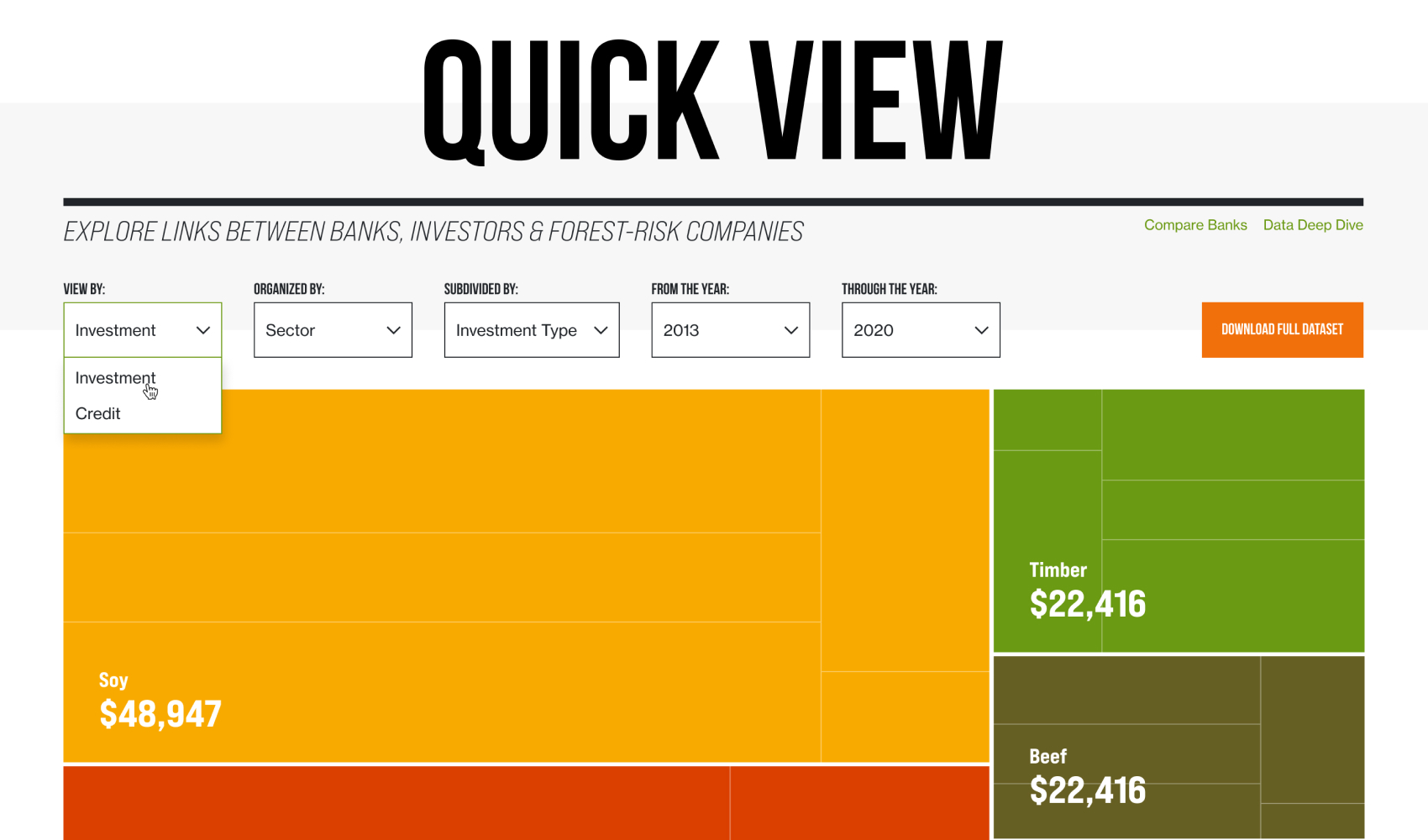

Explore how much money flows into different forest-risk commodity sectors across tropical forest areas during specific timeframes.

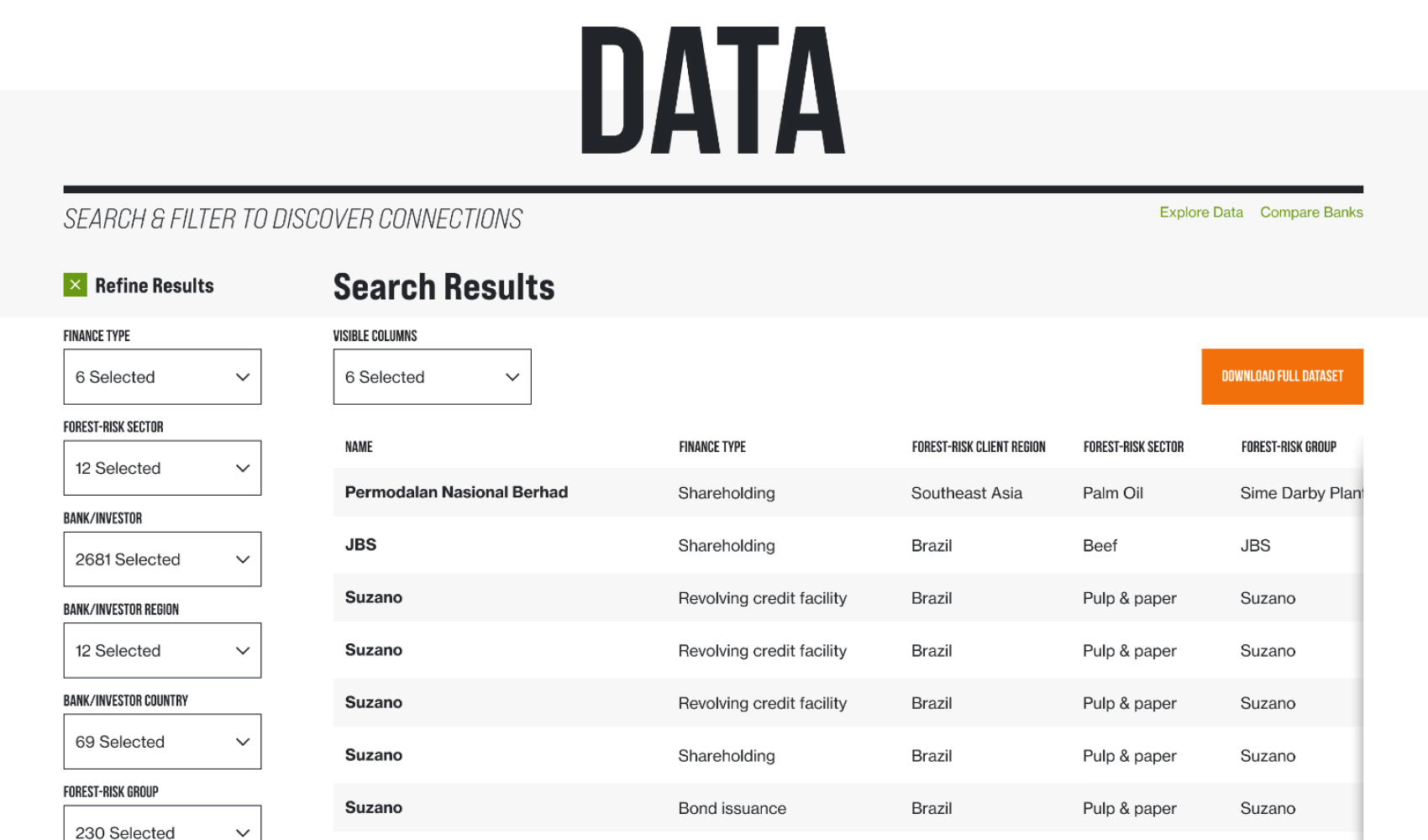

Dig deeper into our database of banks, investors, and deforestation-risk companies, with up to 10 search criteria options.

See how banks and investors measure up on environmental, social and governance (ESG) policies and their exposure to forest-risks

Beta Data Set

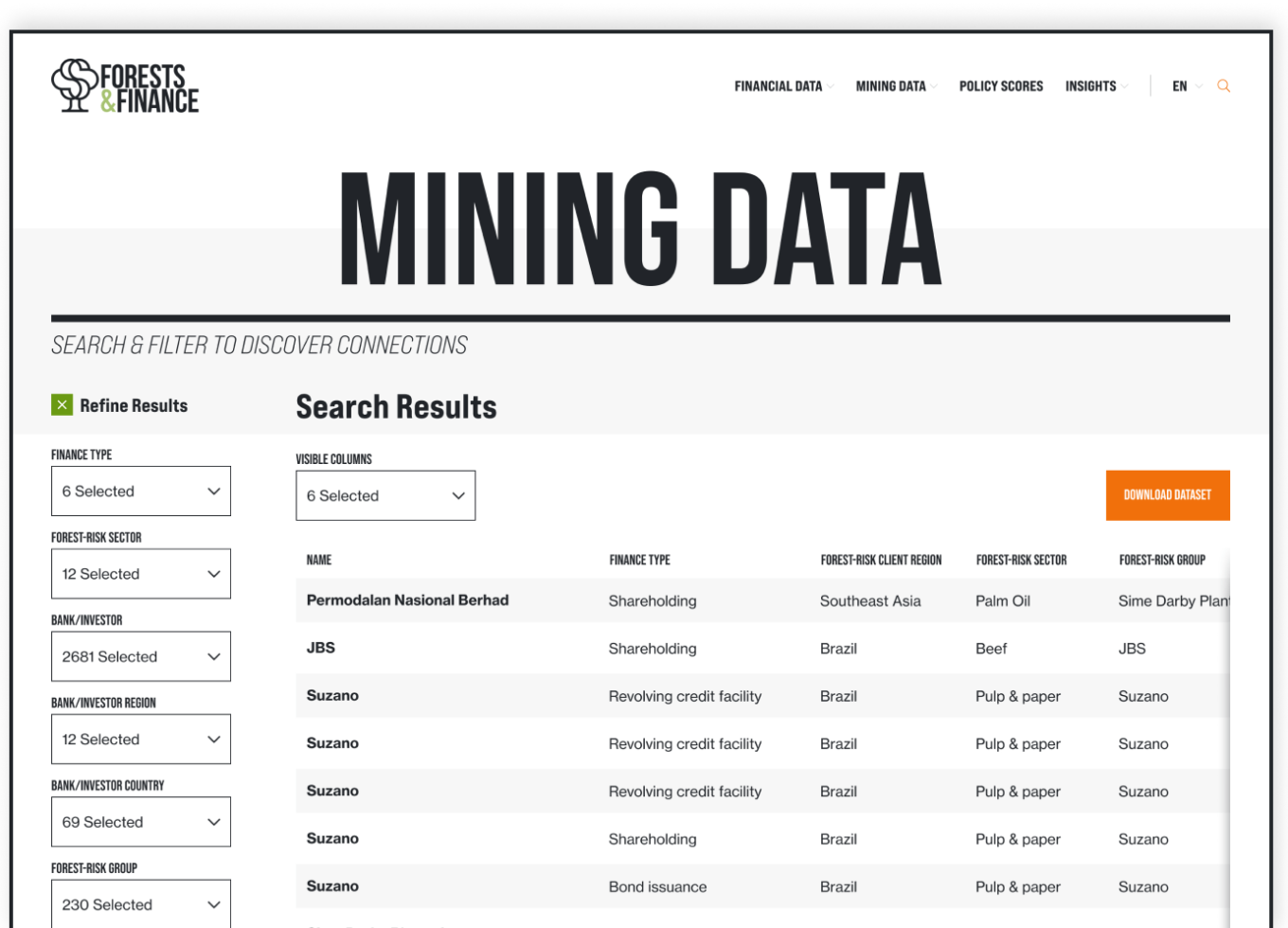

Forests & Finance has launched a new dataset (in beta version), which assesses the finance received by mining companies whose operations may impact natural tropical forests and the communities that rely on them in Southeast Asia, Central and West Africa, and parts of South America.

This project assesses the financial services received by over 300 companies directly involved in the beef, soy, palm oil, pulp and paper, rubber, and tropical timber (“forest-risk sector”) supply chains, whose operations impact natural tropical forests in Southeast Asia, Central, and West Africa, and parts of South America.

The financial data was retrieved from: financial databases (Bloomberg, Refinitiv, Thomson EMAXX, TradeFinanceAnalytics, and IJGlobal); company reports (annual, interim, quarterly) and other company publications; company register filings; as well as media and analyst reports. These were used to identify corporate loans and underwriting facilities provided to the selected companies for the period 2013-2022 (September), and bondholding and shareholding data for September 2022.

Companies with business activities outside of the forest-risk sector had recorded amounts reduced to more accurately present the proportion of financing that can be reasonably attributed to the forest-risk sector operations of the selected company, in the selected regions and countries (see Adjusters).

For more information, please see the methodology section.

Featured Story Using Our Data

All you always wanted to know about the

Taskforce on Nature-related Financial Disclosures (TNFD), including:

– What is the TNFD?

– What does it try to do?

– What are the major shortcomings of the TNFD?

We seek to improve financial sector transparency, policies, systems, and regulations to prevent financial institutions from facilitating systemic adverse Environmental, Social and Governance (ESG) impacts that are all too common in the operations of many forest-risk commodity sector companies.