On March 12 and 18, the ECB announced a further €870 billion in asset purchases (Asset Purchase Program) through an increase of €120 billion in its quantitative easing programs and the creation of a €750 billion Pandemic Emergency Purchase Program (PEPP).

A total of €1.01 trillion in securities repurchases will be carried out over the year, representing 38% of the securities held by the Bank in February 2020. These funds make it possible to buy:

- Bonds issued by governments, local authorities or international organisations via the Public Sector Purchase Program (PSPP);

- Corporate bonds, with a maturity between six months and 31 years, via the Corporate Sector Purchase Program (CSPP);

- Bonds issued by banks and covered by assets via the Covered Bond Purchase Program 3 (CBPP3); and

- Asset-backed bonds via the Asset-Backed Securities Purchase Program (ABSPP).

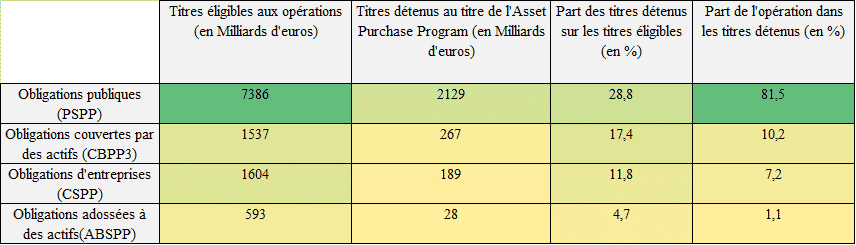

The current distribution of asset buybacks is summarised in the following table:

Calculation : Reclaim Finance ; Data : BCE

Note: data for February 2020 for securities held and December 2019 for eligible securities.

The ECB uses a purchase allocation key which limits purchases of sovereign debt to one third of a government’s debt. It also limits purchases of other securities to a share in proportion to each country’s share in the ECB’s capital. This key is maintained but could be revalued at a later date (1).

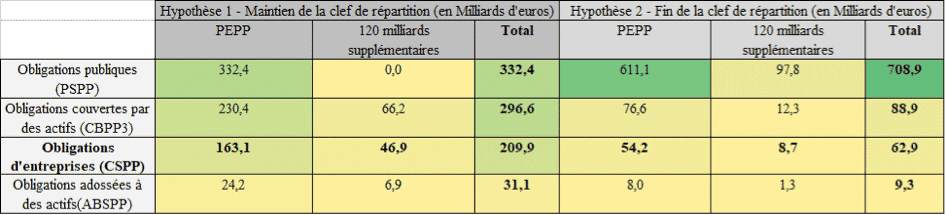

The proposed calculations are therefore based on two assumptions:

- The maintenance of the key for holding sovereign debt; and

- The removal of the key, with an alignment of the allocation of new funds with the existing allocation.

On the basis of these assumptions, it is possible to assess the effect of the new quantitative easing measures on the financing of the various securities purchase transactions:

Calculation: Reclaim Finance ; Data: BCE

Note: data for February 2020 for securities held and December 2019 for eligible securities.

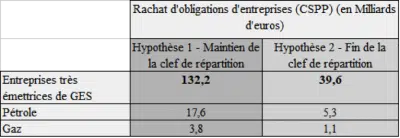

Based on the analyses of Positive Money, the Veblen Institute (2) and the Grantham Research Institute (3), it can be estimated that the buybacks of corporate securities and bonds (CSPPs) alone would provide substantial financing for the most polluting sectors.

Calculation : Reclaim Finance

It should be noted that asset purchase programs other than CSPP are not without environmental consequences. For example, the support provided to states and banks through the CSPP and CBPP3 has a variable effect depending on the climate policy of the state and bank in question.

Moreover, the extended and indiscriminate modalities of the new PSPP should logically contribute to the financing of polluting sectors that constitute an important part of the current economy (see our article “The ECB Prescription against Coronavirus: an omission of social as well as environmental ills”).

(1) ECB announces €750 billion Pandemic Emergency Purchase Programme (PEPP)

(3) The Grantham Research Institute and LSE, Mai 2017, The climate impact of quantitative easing